Payment for unutilised annual or medical leave. Is a drivers trip allowance subject to EPF contribution.

Must Know Things About Epf In 2022 And Much More

In general all monetary payments that are meant to be wages are subject to EPF contribution.

. Wages for half day leave. Dear Colleague Your Question is. The payments below are not considered wages by the EPF and are not subject to EPF deduction.

EPF deduction in leave bonus and conveyance and laundry allowance is mandatory. The interest on the EPF amount is taxable as per applicable income tax slab rates. However the following allowances shall be excluded.

The rate of contribution is 12 each from the Employee with a matching contribution from the Employer. Yes and it will be paid as current contribution. Payments Exempted From EPF Contribution.

Is Travelling allowance subject to EPF. Allowance except travelling allowance is included in the definition of wages under the EPF Act. If you do not withdraw the EPF funds post three years of retirement you will have to pay tax on the interest earned.

Any advance made under the EPF Scheme is exempt from tax. Section 43 1 EPF Act 1991. In short yes bonuses and cash allowances are considered to be part of your wages.

The nature of payment of conveyance and laundry allowance is to be. 5 years 6 months ago 1041. The Employees Provident Fund EPF or commonly known as Kumpulan Wang Simpanan Pekerja KWSP is a social security institution formed according to the Laws of Malaysia Employees Provident Fund Act 1991 Act 452 which manages the compulsory savings plan and retirement planning for private sector workers in Malaysia.

Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third Schedule. Wages for maternity leave. Monthly contributions are made up of the employees and employers share which is paid by the employer through various methods available to them.

The employee and employer each contribute 12 of the employees basic salary and dearness allowance towards the EPF scheme. Additionally the following list of payments must be included when calculating EPF contributions for employees in Malaysia. Service charges tips etc Overtime payments.

Wages in lieu of notice of termination of employment. Replied by Kap-Chew on topic PetrolFood Allowance is part of EPF Contribution. Payments Exempted From EPF Contribution.

Payments Subject to EPF Contribution. EPF withdrawals post-retirement age of 58 years is completely tax-free. While an employee may have the option to increase hisher EPF contribution subject to certain conditions the employer is not obligated to increase his share beyond the ceiling limit.

Other contractual payments or otherwise. Wages for maternity leave study leave half-day leave. Are salary adjustments subject to EPF contribution.

Payment for unutilised leaves including annual. Remuneration that subject to EPF Deductions. Gratuity payment given for excellent service Retirement benefits.

Allowances with some exceptions Commissions. Wages for study leave. Hi Aries For any Variable Pay that you would not want to contribute for Tax SOCSO or EPF just uncheck the relevant options in Variable Pay setup.

Yes unless the work is considered as overtime. For example employee A earns RM6000 per month as their basic salary. Further these allowances are subject to EPF contributions.

Can any one provide Include and exclude Allowances list under EPF. EPF is a great way to get someone other than yourself namely your employer to contribute to your retirement. Are wages paid for work during holidays public holidays annual leave subject to EPF contribution.

Here what is the real meaning of Leave Bonus is to be examined from all legal perspective. Membership of the EPF is. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the Third Schedule.

EPF contribution is that it qualifies for tax deduction by way of personal relief. Payments for unutilized annual or medical leave. Dividends generated from EPF are also exempted from tax.

Allowances which are variable in nature including leave encashment overtime house rent allowances canteen allowances which are specifically paid to workers who are required to remain on machines during lunch period. Allowances except a few see below Commissions. The Employee contribution is completely allotted to Employee Provident Fund EPF while the Employer contribution is bifurcated between EPF 367 and Employee Pension Scheme EPS 833.

The payments by the employers subject to deductions are. Monetary payments that are subject to EPF contribution are. Other incidental allowances which are related to traveling such as transport allowance outstation allowance food allowance car allowance handphone allowance are subject to EPF contributions UNLESS the said payments are reimbursement in.

Generally all wages paid to the directorsstaffemployeeworkers are subject to EPF deductions. However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference.

Epf Loan Store 52 Off Www Ingeniovirtual Com

Epf Vs Eps Know The Major Differences And How It Works

All About Epf Employee Provident Fund Enterslice

Karur Vysya Bank Kvb Holiday List In 2021 Kerala Kvb Holidays Kerala

Declaration Of Rate Of Interest For The Employees Provident Fund Members Account For The Year 2021 22 Https Www Staffnews In 2022 In 2022 Fund Accounting Government

Epf Vs Ppf Vs Vpf Ctc And Salary Slip India

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Regulation Of Inquiries Under Section 7 A Of The Epf Act The Need Of The Hour Scc Blog

Difference Between Epf And Eps Employee Pension Scheme Ebizfiling

Why Epf Is Still A Winner Despite Lowest Rate In Over Four Decades

All About Epf Employee Provident Fund Enterslice

Cash Management Guidelines Ministry Of Finance Clarification Dtd 17th February 2021 Cash Management Management Finance

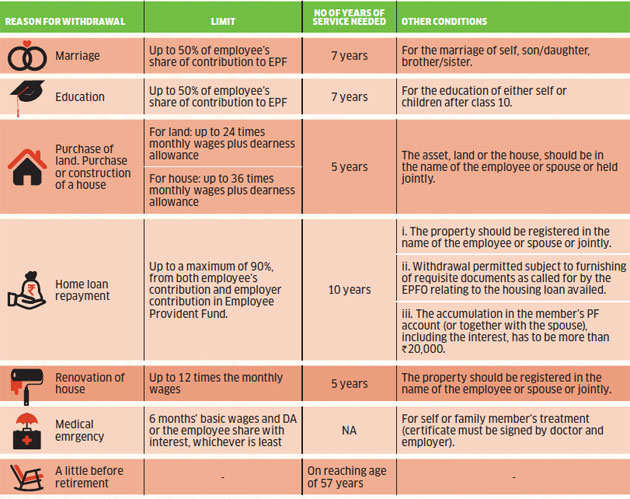

Epf Withdrawal Rules 2022 All You Need To Know

What You Need To Know About Epf Accounts Businesstoday Issue Date Feb 28 2013

After Reducing Epf Interest Rate To 8 1 Epfo Wants Increase Equity Investment Limit To 25

How To View Epf Passbook And Track Contributions Interest Transfer Withdrawal

What You Need To Know About Epf Accounts Businesstoday Issue Date Feb 28 2013

Challan 280 Know How To Fill Income Tax Challan 280 Online Offline

- manfaat reaktor nuklir

- download lagu atmosfera berakhirlah sudah

- allpipes technology sdn bhd

- undefined

- is allowance subject to epf

- gambar rumah sehat untuk diwarnai

- mazda 3 deep crystal blue

- jadwal kereta api dari tegal ke cirebon

- terima kasih tuhan yesus memberkati

- kata kata bijak untuk pengecut

- dermasiswa jpa b40 2019

- kata mutiara pacar lagi sakit

- gambar jenis anggur

- dekorasi ruangan kelas paud

- simpulan bahasa jauh hati

- jenis tapak kaki dan kasut

- hadiah jamuan guru

- sejarah bola basket ke indonesia

- kata kata indah saat mati lampu

- kata kata mutiara untuk ucapan tidur